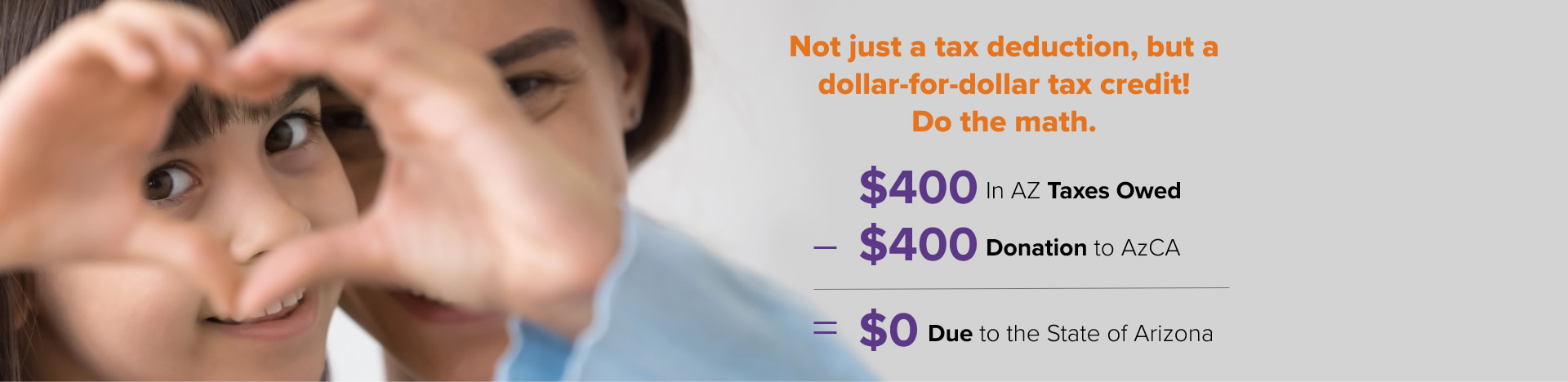

TAX CREDIT

Did you know that you can help Arizona’s children and families in need, and yourself?

In Arizona, you can decide how your tax dollars are spent. A donation to Arizona’s Children Association may qualify you for the Arizona Qualifying Charitable Organization Tax credit serving low income families. Couples who file jointly can reduce their state taxes by up to $938; individuals can claim a tax credit of up to $470.

Although we do not qualify for the foster care tax credit, this tax credit program is a separate state program. This means you can make qualifying donations for the foster care and school or education tax credits, and you may claim all three deductions – click here to see the breakdown. You do not need to itemize to take advantage of this opportunity. Please consult your tax advisor for details.

Our Tax ID # is 86-0096772 and Qualifying Charitable Organization (QCO) Code is 20699.

Donations can also be mailed to one of our corporate offices, Attn: Donor Relations.

Phoenix Corporate Office | 7600 N. 16th St. Suite 110, Phoenix, AZ 85020

Tucson Corporate Office | 4750 N. Oracle Rd., Ste 106, Tucson, AZ 85705

For more information, please contact Jim Van Wicklin, Sr. Director of Development & Marketing at jvanwicklin@arizonaschildren.org.

Donation

FREQUENTLY ASKED QUESTIONS

Donor Privacy Policy

Arizona’s Children Association (AzCA) is committed to maintaining your trust and protecting your privacy. This privacy policy is intended to protect and secure the personally identifiable information (any information by which you can be identified) that you provide to us. We maintain the privacy of your information using security technologies and adhere to policies that prevent unauthorized use of your personal information. If you desire to review your information, request corrections or special requests, or remove your name from our postal mailing list, you can email us at info@arizonaschildren.org or mail to Donor Relations, 3636 N. Central Avenue #200, Phoenix, AZ 85012, and request to be removed from our list. You can unsubscribe from email communications by clicking on the unsubscribe link present in all our messages, or by replying to sender with “remove” in the subject line. To ensure philanthropy merits the respect and trust of the general public and that donors and prospective donors have full confidence in our organization, AzCA adheres to the Association of Fundraising Professionals’ Donor Bill of Rights.

Information We Collect

We collect information from visitors through online requests, online donations and information provided to us at community events. Information collected usually includes name, address, city, state, zip, phone number, email address, contact preferences and, in the case of donations, credit card number and expiration date. In order to track what AzCA programs you are most interested in, we may also collect information on your area of interest, such as parenting specific programs or programs that support assault survivors. We also collect anonymous information on which portions of our website visitors access or visit. We monitor and track information such as usage patterns of visitors to our website. We use this information to improve our website, our operations and our client service.

How the Information Is Used

AzCA uses your information to understand your needs and provide you with better online and mail service. We may use your information to complete a transaction, issue you an income tax receipt for a donation, or to personalize our Web site for you. Credit card numbers are used only for donation or payment processing and are not retained for any other purposes. In addition, we may periodically send you e-mail announcing news and event information. If you choose to supply your postal address, you may receive mailings from us as well.

Security

AzCA is committed to ensuring the security of your personal information. To prevent unauthorized access, maintain data accuracy, and ensure the proper use of information, we have established and implemented appropriate physical, electronic and managerial procedures to safeguard and secure the information we collect online. AzCA uses Blackbaud NetCommunity when collecting or transferring sensitive data such as credit card information. Any information you enter is encrypted at your browser, sent over the public Internet in encrypted form, and then de-encrypted at our server.

Donation Refund Policy

If you have made an error in making your donation or change your mind about contributing to Arizona’s Children Association, we will honor your request for a refund made within 72 hours of your donation. Refunds are returned using the original method of payment, except cash donations will be returned via check. If donation was made by credit card, refund will be credited to that same credit card. To request a refund, call (800) 944-7611 ext.2305 or email info@arizonaschildren.org.

Your financial support directly impacts our ability to bring programs and services to those who need them.

English

English Spanish

Spanish